Demographic dividends contributed to more than one-third of the real GDP growth in Taiwan from 1970 to 2004 (Liao, 2011). However, as summarized by the 2018 population projection for Taiwan, the peak of the percentage of the working-age population (aged 15-64) occurred in 2012, and the percentage of the elderly (aged 65 and above) exceeded 14% in 2018. According to the definition made by the United Nations, these statistics indicate that Taiwan became an aged society in 2018 and will become a super-aged society (with individuals aged 65 and above representing more than 20% of the population) in 2026.

Population aging raises a number of public issues. One important issue is an increasing demand for medical services, which leads to rapidly growing public medical expenditure for at least three reasons. First, on average, the elderly need more health care than the young. More old people imply a fast increase in medical expenditure. Therefore, in a society with a universal health insurance program, the government has to raise taxes to finance the extra public medical expenditure. Second, population aging (more old people and fewer young people) means that there are fewer tax payers. Even if the tax rate remains unchanged, the tax burden on each tax payer will be higher. Third, an increase in taxes discourages labor supply and thereby results in an even higher tax burden.

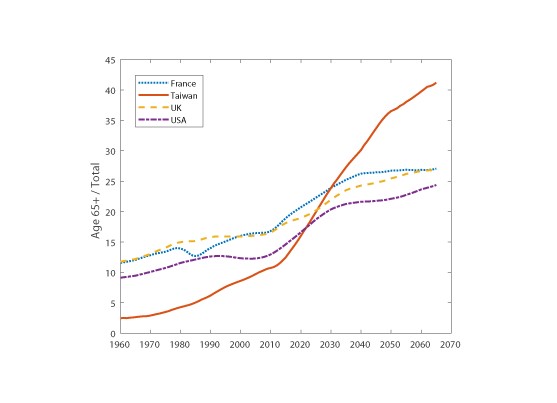

Taiwan has implemented a national health insurance program since 1995. The aforementioned financing issue is unavoidable in the near future. Furthermore, as shown in Figure 1, because of the lower total fertility rate, the speed of population aging in Taiwan will be much faster than that faced by developed countries. For example, it will take only 8 years for Taiwan to move from an aged to a super-aged society, while 15 years will be needed for the United States, 29 years for France, and 51 years for the United Kingdom. Fast population aging implies that the aging pressures faced by a society will be concentrated within a short period of time. The ability to ensure the sustainability of the national health insurance program will become a serious challenge for Taiwan in the near future.

Financing issues due to aging will be a common problem in newly industrialized countries. Hsu and Liao (2015) take Taiwan as an example to investigate the impacts of fast population aging on the financing of a national health insurance program. A dynamic general equilibrium stochastic aging framework is constructed. An individual enters the economy as a young agent, facing both idiosyncratic productivity and medical expenditure shocks. When the young agent is hit by a retirement shock, the agent retires from the labor market and becomes an old agent. An old agent also faces a medical expenditure shock and leaves the economy when he/she is hit by a death shock. In addition, a national health insurance program is considered in the model to cover a part of the individual’s medical expenditure. The national health insurance program is financed by the national health insurance tax.

The theoretical model is calibrated to Taiwanese society in the 2000s to be the benchmark economy. Several quantitative experiments are conducted. First, the benchmark economy is compared with two aging scenarios that employ the Taiwanese population projections in 2030 and 2050. All else being equal, Hsu and Liao (2015) find that if the current demographic trend continues until 2030, an additional 7 percentage points of labor income tax will be required to sustain the national health insurance program, and an additional 16 percentage points of labor income tax will be required in 2050. More realistic scenarios, such as an economy with productivity growth and growth of the medical price, are also considered. Second, financing the national health insurance by different tax tools is explored. Compared with raising the labor income tax rate, taxing consumption or capital income would result in welfare improvement, while adjusting other social welfare expenses to finance the extra public medical expenditure would lead to welfare loss. Third, a possible policy is discussed: encouraging the delay of retirement. Hsu and Liao (2015) find that, in the aging scenario of 2050, the extra labor tax burden can be reduced from 16 percent to 8 percent if the average retirement age is postponed from age 55 to age 75. Welfare is also improved under this policy.

Because of low fertility rates and longevity, newly industrialized countries, similarly to Taiwan, will face rapid population aging in the near future. Labor shortages and government financing problems will become unavoidable challenges. With a relatively short period of time to respond to aging, it is important for these countries to design appropriate policies immediately. In addition, there exist other important issues for an aging society that are not yet fully explored, such as long-term care and financial and mental support for the elderly. These issues are worth further research.

Figure 1. Ratios of the elderlyData source: World Population Prospects: The 2017 Revision, United Nations; Population Projection for R.O.C (Taiwan): 2018-2065, National Development Council, Executive Yuan, Taiwan.

References

1. Hsu, M., & Liao, P. (2015). Financing national health insurance: The challenge of fast population aging. Taiwan Economic Review, 43(2), 145-182. doi:10.6277/TER.2015.432.1

2. Liao, P. (2011). Does demographic change matter for growth? European Economic Review, 55(5), 659-677. doi:10.1016/j.euroecorev.2010.09.006

3. Taiwan, National Development Council, Executive Yuan. (2018). Population Projections for R.O.C (Taiwan): 2018-2065. Retrieved May 9, 2019, from https://www.ndc.gov.tw/en/cp.aspx?n=2E5DCB04C64512CC

Pei-Ju Liao

Associate Professor, Department of Economics

pjliao@ntu.edu.tw